It’s been quite the September … after a slower summer, things have definitely picked back up significantly: Great to catch up with many of you (our fellow early stage peers), things have been much more active on the deal front and we’re excited to close out this interesting year with a strong quarter.

Here are the reads and resources we found useful this month.

Reminder: We spend a lot of time thinking about our own firm building at Darling Ventures. In this monthly newsletter, we share insightful reads and resources as well as our own thinking about venture firm building with our fellow early-stage peers, to learn alongside each-other and maintain an ongoing dialogue that makes us all better at building standout firms for our founders and LPs.

🏗️ Firm Building

Useful nuggets published on firm building.

1. How VCs use SPVs

Reading Time: ~10mins

According to Assure, our industry is still in the early innings of using SPVs. In their report, they cover topics such as characteristics of firms that use SPVs, how they are used, terms, and much more. Access it directly here.

2. Benchmark Capital

Listening Time: ~3.5hrs

Captivating and well researched (as always) episode about Benchmark on the Acquired podcast by Ben and David. Lots to learn for anyone currently building a venture firm.

Things that stood out to us include the number of successful generational transitions they’ve gone through and how bold Benchmark was from the beginning. Including charging 30% carry out of the gate (when everyone was still doing 2% + 20%) and answering “there is always room at the top” to the question as to why the world needed another venture firm … to then deliver a 92x on their first $85M fund!!! Plus a 25x on a $550M fund a few funds later!

3. What It’s Really Like to Run a Pre-Seed VC Firm

Reading Time: ~3 min

“How do you spend your time as a VC (that is building a firm)?” - A question we all get asked a lot from people outside of our industry. Alex from our friends at 2048 does a great job at explaining what all goes into running a pre-seed venture in his recent post. We’ll definitely be using this the next time we get asked …

4. Roelof Botha on Investing with the Best

Listening Time: ~2hrs

On this great episode of the Tim Ferris Show, Roelof talks about investing with the best, founder-problem fit, how to use pre-mortems and pre-parades, learning from crucible moments, and daring to dream.

There are many examples of people that eventually lose their hunger after seeing a lot of success. Not Roelof. It’s inspiring to hear how naturally curious, eager to learn, humble and driven he remains despite all of his achievements.

🤝 For Your Founders

Reads we’ve shared with our founders this month.

1. Stop Pitching, Start Storytelling

Reading Time: ~5mins

Sydney Fulkerson of Sunflower Fund did a great write up on Stonks on storytelling for startups. Including the #1 feedback we always give: “Say way, way less than you think you need to”.

If anyone in your early portfolio needs help on storytelling, we can highly recommend getting in touch with her.

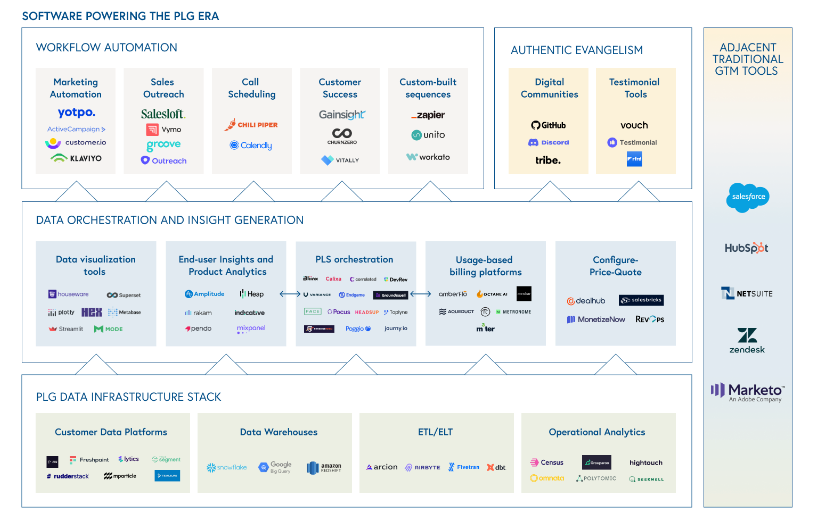

2. The PLG Tech Stack

Reading Time: ~10mins

Who in your portfolio isn’t at least thinking about PLG? This write-up by BVP (shoutout Janelle, Andrew, and Sameer) does a great job at laying out the tech stack powering PLG startups.

3. Product-Led Acquisition

Reading Time: ~5mins

On the topic of PLG, Julian Shapiro wrote a great piece on four ways startups can integrate product-led acquisition into their product. The one we had thought about the least explicitly in this context is “how to turn your product into a billboard” - i.e. that a user’s use of your product is visible to others around them (think e.g. Calendly).

🤨 Something Fun

Fun and (more or less) useful things we’ve read this month.

1. AI Bringing Celebrities Back to Life

Read Time: ~1mins

Artist Alper Yesiltas uses AI to create images of celebrities “as if nothing happened” (meaning as if they were still alive today). Mind blowing 🤯

2. Free Chrome Extensions That Will Change Your (Work) Life

Read Time: ~1min

Great suggestions re Chrome extensions that will make your life easier by Johnny Brown.

Our favorite (that isn’t on the list) is the one to download DocSends 🫢🤫

Download zip file: https://www.dropbox.com/s/3xu7zhemgrtwluv/DocSendDownloader-master.zip?dl=0

Unzip folder and navigate to chrome://extensions/ on Google Chrome

Toggle Developer Mode on the top right if not toggled already

Click Load unpacked and navigate to the directory of the unzipped file

3. The Optimal Morning Routine

Watch Time: ~17mins (half that at 2x speed 😉)

A great watch for anyone looking to get a better start to the day. Amongst others, we learned that we should wait 90’ before drinking our first coffee in the morning. As impossible as it sounds ☕ (Pascal doing better at this practice than Sydney 🙃)

Andrew Huberman, who made the video, is a neuroscientist and tenured Professor in the Department of Neurobiology at the Stanford University School of Medicine. He also runs Huberman Lab which includes a great podcast.

🤔 What We’re Thinking Through

Venture firm building topics that are currently top of mind for us at DV.

1. Communication Groups with High Engagement / Low Spam

We’re in the process of setting up curated Slack groups including for our founders and exec operators. Slack comes with the upside of low friction to adoption but preferences differ - some like Teams, Discord or even WhatsApp better while others prefer broader community platforms like Tribe, Discourse, Circle, etc. We’ve looked at them all before going back to our initial choice Slack and are spending time thinking about how to best set up channels with high engagement / low spam out of the gate.

If this is something you’re thinking through as well, we’d love to trade notes - just hit reply 👋

⏩ Follow-Up from our last newsletter: Sub $50M M&A exits

We’ve seen a bunch of newsletters that have asks or call-to-actions, that rarely follow-up on outcomes. Last month we wrote:

We have a couple of founders in our portfolio that are thinking through finding a new home via an acquisition in the sub $50M range.

If you / people in your network have any expertise in this, we’d love to chat.

Big thanks to those who reached out to us on the above - we’ve gotten input on both process as well as service providers that specialize on early / smaller exits. Happy to share our notes with you if of interest.

👋 Get in Touch

Want to chat about venture firm building, come across great articles to include in this newsletter, have feedback for us or want to catch up potential deals, please reach out!

Quick reminder: We, Darling Ventures, focus our investing on North America based startups selling software to businesses and individuals at work at the Pre-Seed with checks up to $750K.

Great work, this was a really interesting read!