Hard to believe it’s almost already time for the 🦃 - feast again. If you’re looking for things to do when our industry is (mostly) on pause for a few days, we got you 😉 - here are the reads and resources we found useful this past month.

Happy reading.

🏗️ Firm Building

Useful nuggets published on firm building.

1. The Three-Body Problem

Reading Time: ~15mins

We’re all dealing with the reality that today’s environment is brutal compared to what it’s been like over the past few years. Frank Rotman, Co-Founder / CIO at QED Investors, does a great job at articulating how VC firms can adjust to this “new normal” to find their stable point and continue to access quality LP capital, using the physics analogy of the “Three-Body Problem”.

⏱ Don’t have time for the full report? Listen to this interview with Frank, by Collin and Katalina at Ensemble VC or read Frank’s Twitter thread on the topic here.

2. Build & Benchmark Your VC Platform Strategy

Reading Time: ~5 min

This “oldie but goodie” from Cory Bolotsky is particularly helpful when going into year-end and annual planning conversations around your platform strategy. At Darling Ventures, we are doubling down on “doing fewer things really well” vs. running the gamut but as with most other things in VC land, no size fits all 🤷♀️. We can highly recommend this read if you’re currently thinking through your own platform strategy.

Quick Tip: Build your own Platform matrix here

🤝 For Your Founders

Reads we’ve shared with our founders this month.

1. Exit Right

Reading Time: Book

We recently had the privilege to chat to Mark Achler and Mert Iseri from MATH VP about their new book 📚 Exit Right: How to Sell Your Startup, Maximize Your Return and Build Your Legacy. A great read, especially in a time where more founders are looking for a potential home.

While a successful entrepreneur may exit a handful of companies in their lifetime, many buyers close deals all the time. With this information asymmetry, founders don’t have the tools they need to get the best results for themselves, their teams, or the new parent company.

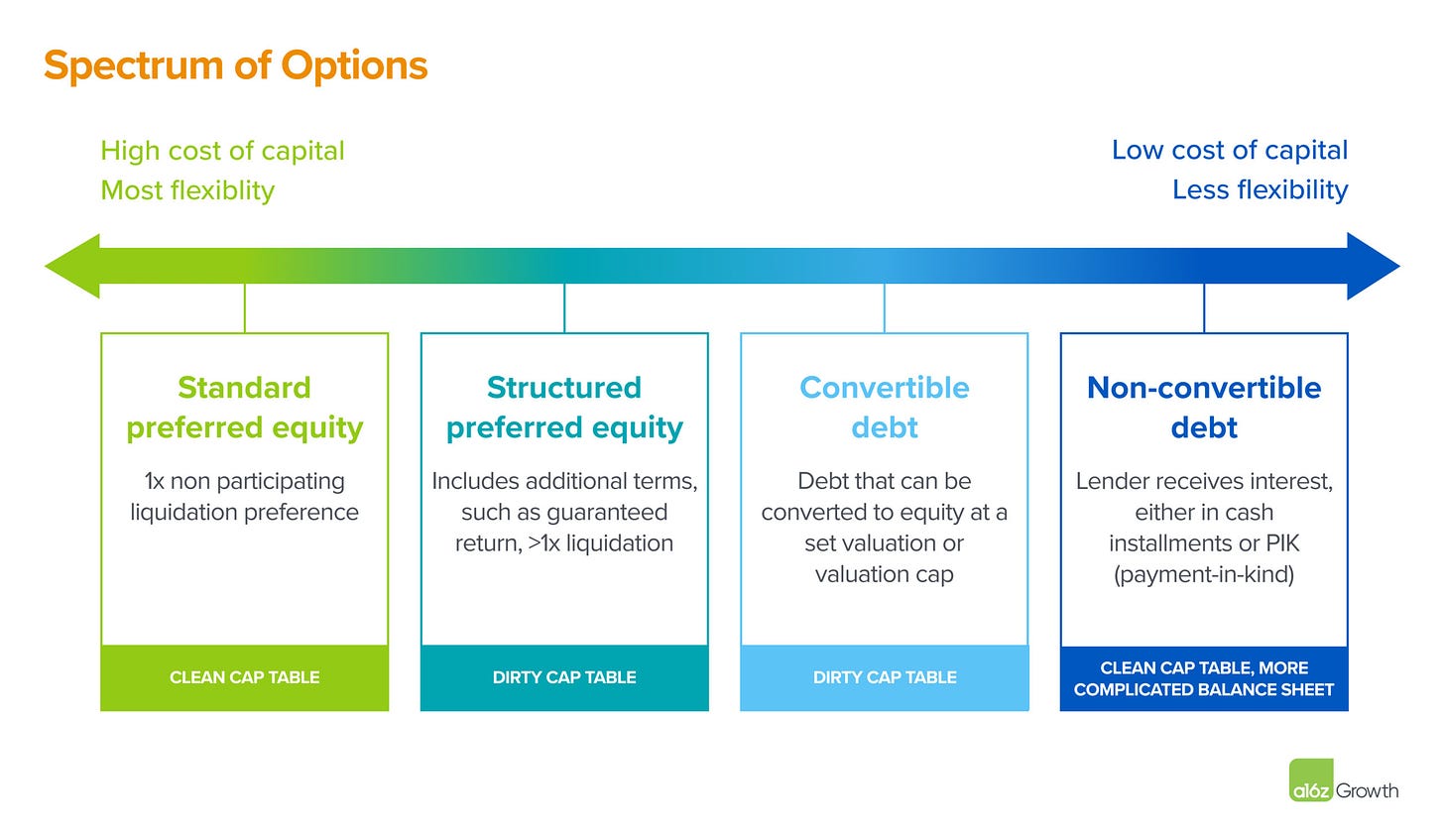

2. Funding When Capital Isn’t Cheap

Reading Time: ~10 mins

With most startups rethinking their capital planning strategy more than once this year, this article by a16z (shoutout Shangda, Alex, and David) does a great job at outlining the spectrum of options when it comes to funding sources for startups to make a better informed decision (if they haven’t done so already).

3. Startup Metrics

Reading Time: ~10 mins

As we all know, raising a round “always depends” on much more than metrics - nevertheless, we find it helpful to be informed on what our downstream investors put out there with regard to milestones to reach. We had shared Point Nine’s 2022 SaaS Funding Napkin in a previous post. Here’s what BCV published on Series A metrics for Dev Tools and here’s what Initialized put out there for Series B metrics.

In line with that, also have a look at the 2022 Finmark Metrics Benchmark Report. The data puts into context what is often a benchmark black box and helps to answer questions like, “what is a healthy startup”, “as we grow how do we prioritize spending”, “what do VCs want from me”, etc.

4. How To Win In A Recession

Reading Time: ~5 mins

Another great thread on SaaS pricing from the guru himself - Patrick from Profitwell. This time, it’s about potential options regarding pricing when the economic environment is getting worse. A must read for every SaaS founder!

🤨 Something Fun

Fun and (more or less) useful things we’ve read this month.

1. Stay On Top Of Developments In AI

Read Time: ~2 mins

Pretty sure we’re not the only ones struggling to keep up with all that is happening in and around AI recently. Bleeding Edge Ai provides a great feed of noteworthy developments in AI. They can also be found on the bird app - worth a follow!

🤔 What We’re Thinking Through

Venture firm building topics that are currently top of mind for us at Darling Ventures.

Founder Onboarding

We’re currently working through upgrading our founder onboarding experience / process, in a way that is authentic, fulsome, and engaging while also trying to make sure we start off the partnership on the right foot vs. all the onboarding tasks / an extensive onboarding document feeling like a burden.

If this is something you’re thinking through as well, we’d love to trade notes - just hit reply 👋

⏩ Follow-Up

We see many newsletters with asks / call-to-action yet there’s rarely a follow up. We aim to do better.

From last month’s newsletter: Setting Up Group Communication Channels with High Engagement / Low Spam

We’re in the process of setting up curated Slack groups including for our founders and exec operators. Slack comes with the upside of low friction to adoption but preferences differ - some like Teams, Discord or even WhatsApp better while others prefer broader community platforms like Tribe, Discourse, Circle, etc. We’ve looked at them all before going back to our initial choice Slack and are spending time thinking about how to best set up channels with high engagement / low spam out of the gate.

We decided to use Slack for the most recent community we officially launched last week (to be announced soon 👀) as it’s the tool we (and most others) use for internal and external communication already.

While the lack of search history beyond 90 days if you’re not using the pro version (which can get expensive quite quickly for large groups) is a bit of a bummer, it’s been a great way to increase engagement within a community that was run over email / through meetings beforehand. Happy to share our notes on launching a Slack channel with community driven engagement out of the gate if of interest.

👋 Chat To Us

Want to chat about venture firm building, come across great articles to include in this newsletter, have feedback for us or want to catch up on potential deals, please reach out!

Quick reminder: We, Darling Ventures, focus our investing on North America based Pre-Seed startups selling software to businesses and individuals at work with checks up to $750K.